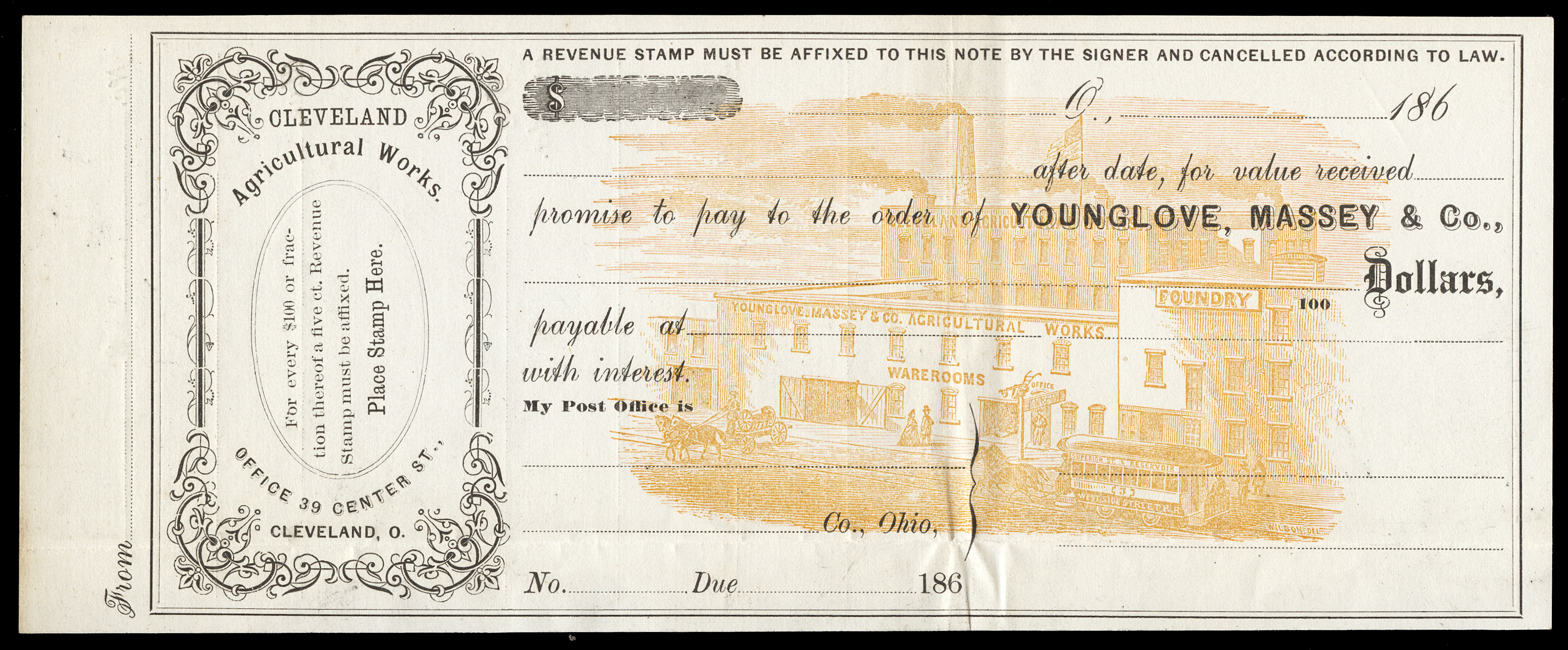

Lovely And Interesting Unused Civil War Era Promissory Note

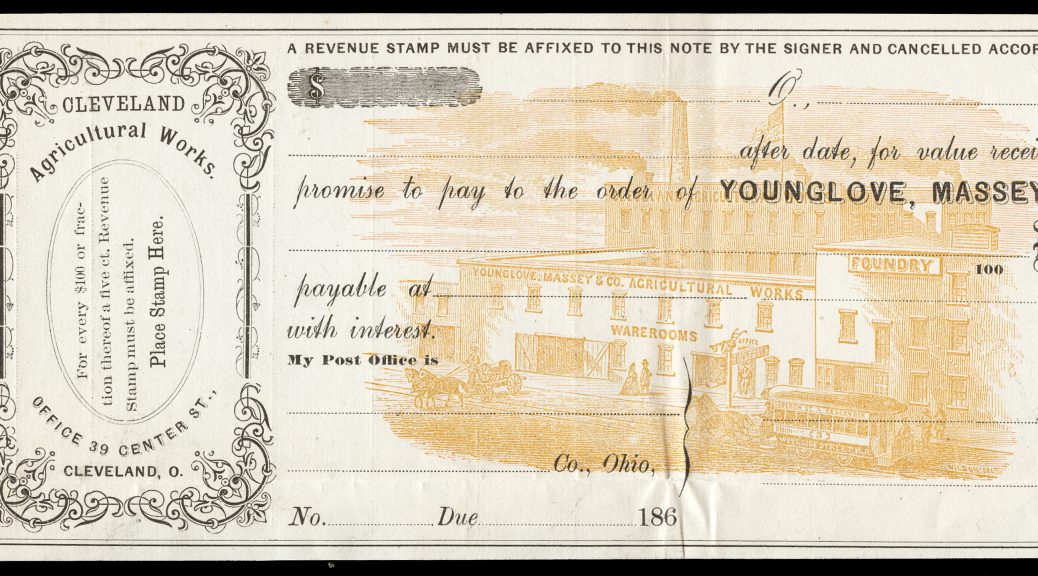

The beautiful scenic underprint in a second color is what initially caught my attention, but additionally the level of detail with respect to paying the tax is quite interesting IMO.

Across the top: “A revenue stamp must be affixed to this note by the signer and cancelled according to law.”

At left: “For every $100 or fraction thereof, a five ct. Revenue Stamp must be affixed. Place Stamp Here.”

You typically don’t see this level of instruction printed on a transactional document. At the very beginning of the tax period, when clerks and other users were unfamiliar with the process, this might make sense… but this document was not printed at the beginning of the tax period. The giveaway is the specific rate instruction “For every $100 or fraction thereof…” This rate was not in effect until August 1, 1864, almost two full years into the tax period. Moreover, this rate was a MAJOR simplification in the calculation of the tax, the third set of inland exchange tax rates, with prior rate schedules being very complicated: the initial rates of October 1, 1862 were graduated based upon the dollar amount of the transaction, and a second set of rates implemented March 3, 1863, which had both a dollar amount and a time duration aspect to calculating the rate.

Given the comparative complexity in calculating the tax leading up to August 1864, I would argue that this document likely was printed even later in the tax period, as to undergo the expense of printing a bicolor document with the specific rate in question, I would think that one would have to have some assurance in the stability in the rate, i.e., it had been that rate for some period of time with no signs of it changing yet again.

Another interesting aspect is the printed prefix “My Post Office is” at center. I’ve not seen that on other promissory notes. The fact that Ohio is filled in implies that these were only to be used in-state? Curious…